Tax Slabs 2025 Usa. Income in america is taxed by the federal government, most state governments and many local governments. The federal income tax has seven tax rates in 2025:

There are seven tax brackets for most ordinary income for the 2025 tax year: Income in america is taxed by the federal government, most state governments and many local governments.

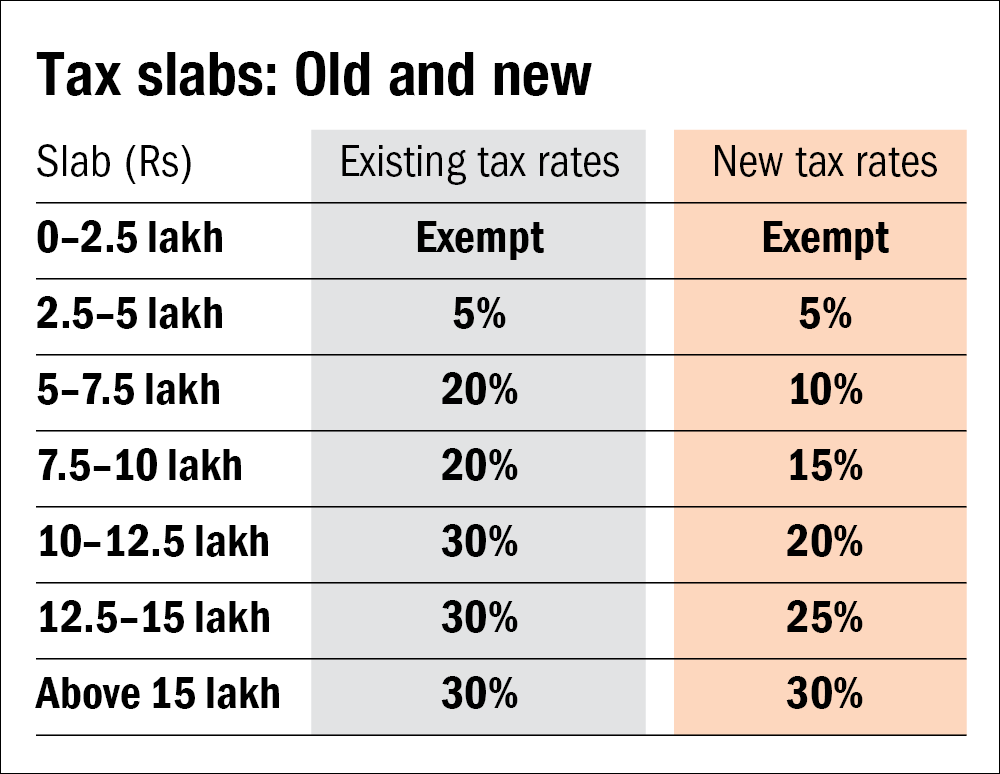

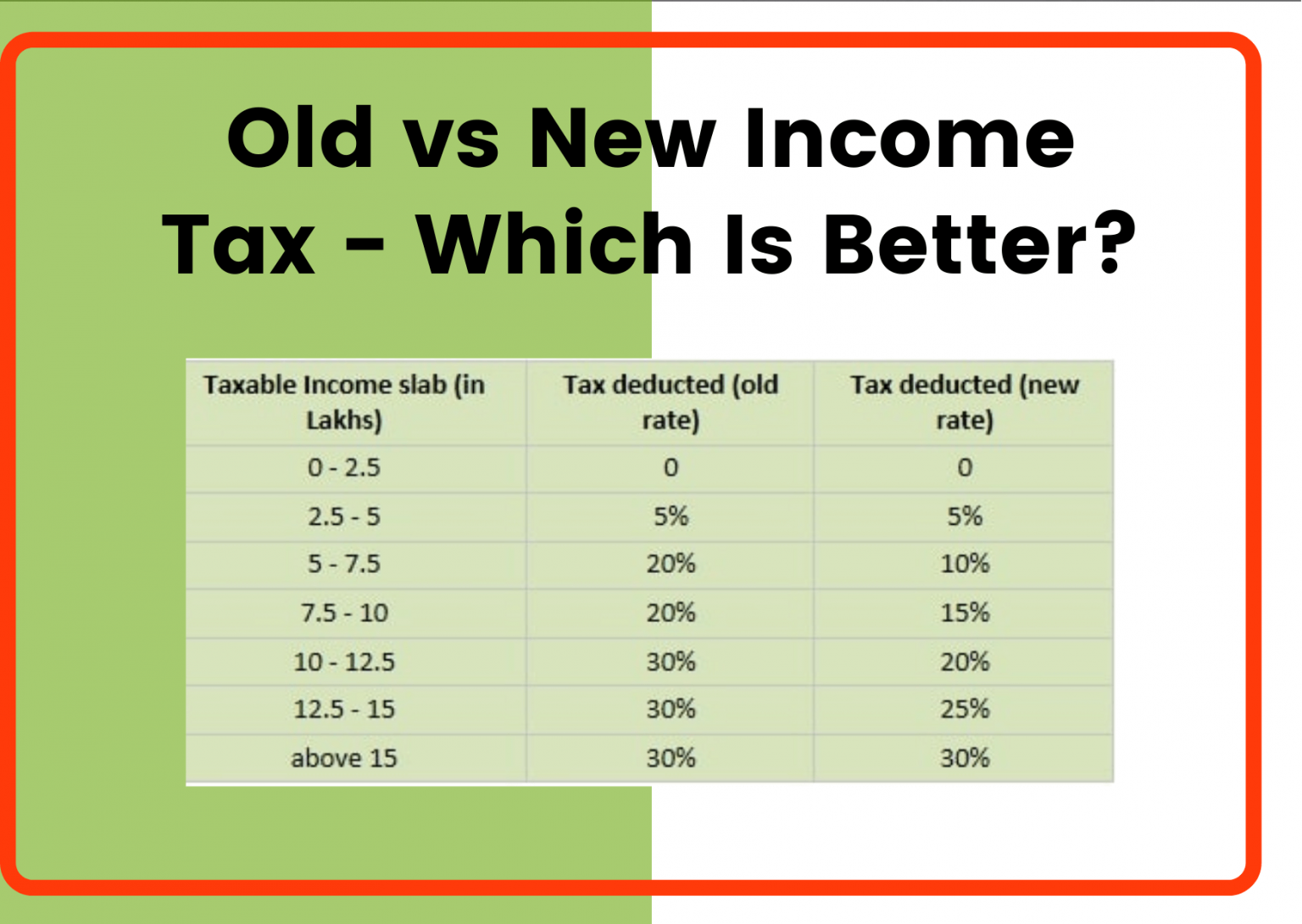

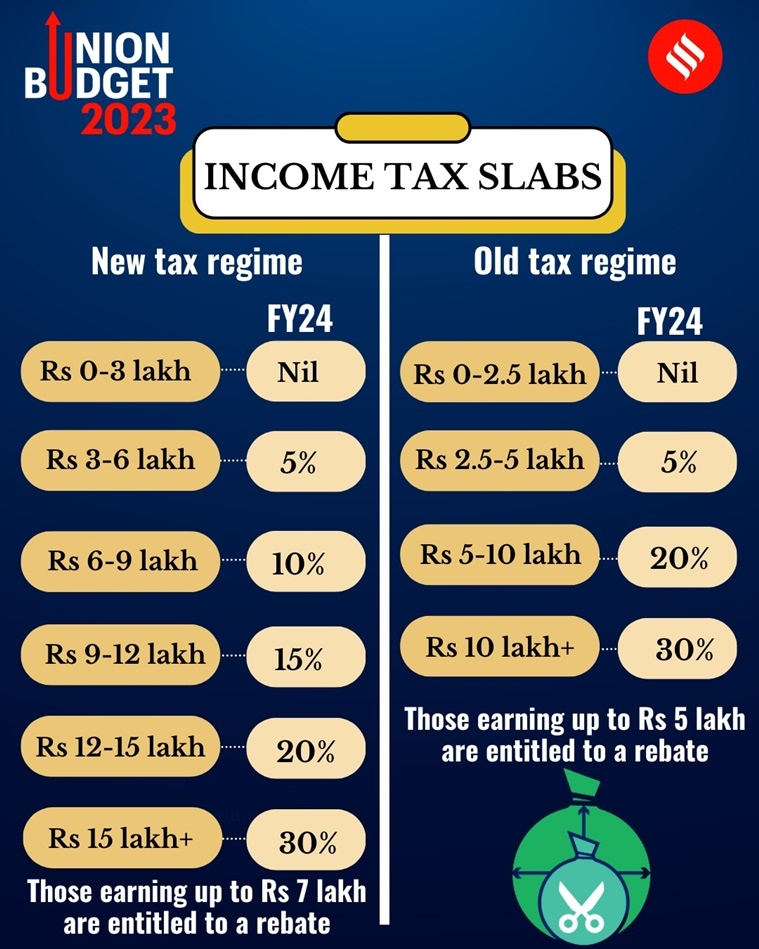

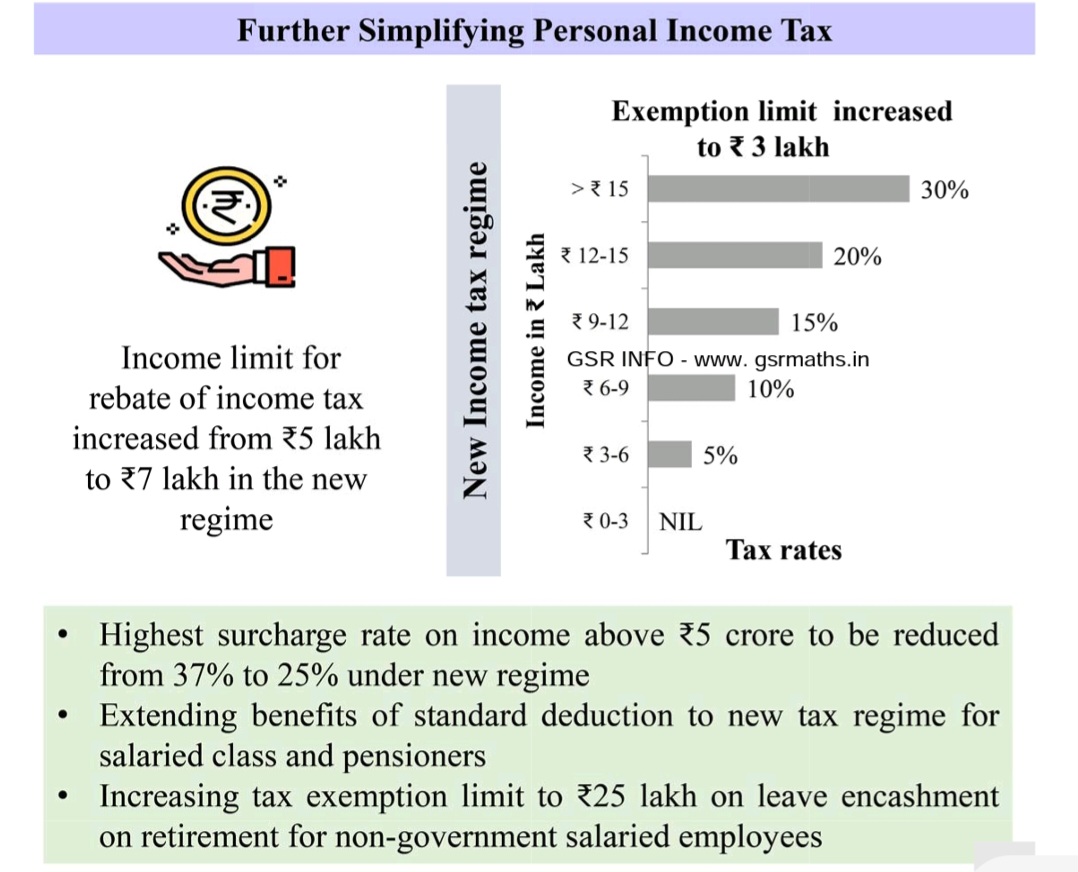

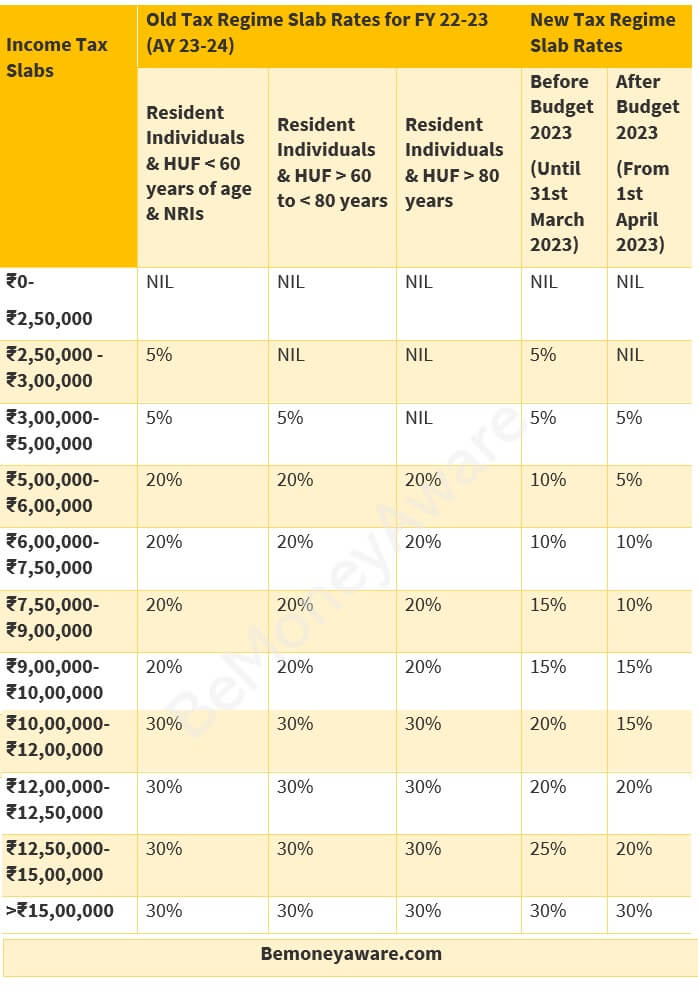

Choosing between the old and new tax slabs Value Research, October 24, 2025 / 4:31 pm. There are seven tax brackets for most ordinary income for the 2025 tax year:

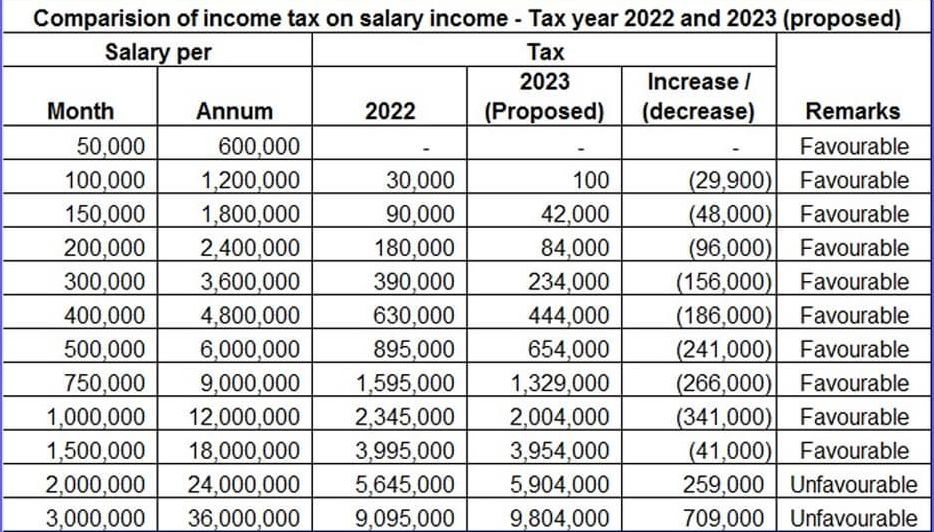

Budget 2025 Tax Slabs Explained New tax regime vs Existing new, Us tax calculator 2025 [for 2025 tax return] this tool is designed to assist with calculations for the 2025 tax return and forecasting for the 2025 tax year. There are seven tax brackets for most ordinary income for the 2025 tax year:

Old vs New Tax Slabs Who should choose what? Save More Money, There are seven federal tax brackets for tax year 2025. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Tax Slab Rate Calculation for FY 202324 (AY 202425) with, The irs will soon set new tax brackets for 2025. The federal income tax has seven tax rates in 2025:

New Tax Slabs Introduced for Salaried Class in Budget 202223, In 2025, the 28 percent amt rate applies to excess amti of $220,700 for all taxpayers ($110,350 for married couples filing. Last updated 21 february 2025.

Will moving to the new tax regime help you? Here's the math, There are seven federal tax brackets for tax year 2025. Income in america is taxed by the federal government, most state governments and many local governments.

Tax Slabs FY 202324 AY 202425 GSR INFO AP TS Employees, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. In 2025, the 28 percent amt rate applies to excess amti of $220,700 for all taxpayers ($110,350 for married couples filing.

oldnewtaxregimeslabs, 2025 and 2025 tax brackets and federal income tax rates. For 2025, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Know the New Tax Slab Rates for FY 202324 (AY 202425) by, Here's what that means for your money. There are seven tax brackets for most ordinary income for the 2025 tax year:

Tax Slabs FY 202324 and AY 202425 (New & Old Regime Tax Rates), The highest earners fall into the 37% range, while those. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ).

The federal income tax rates remain unchanged for the 2025 tax year at 10%, 12%, 22%, 24%, 32%, 35% and 37%.