Payroll Deduction Chart 2025. What’s new for january 1,. Choose the number of employees that you wish to calculate the costs for.

Note that the new jersey payroll calculator will provide individual salary and employer payroll taxes in. The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total.

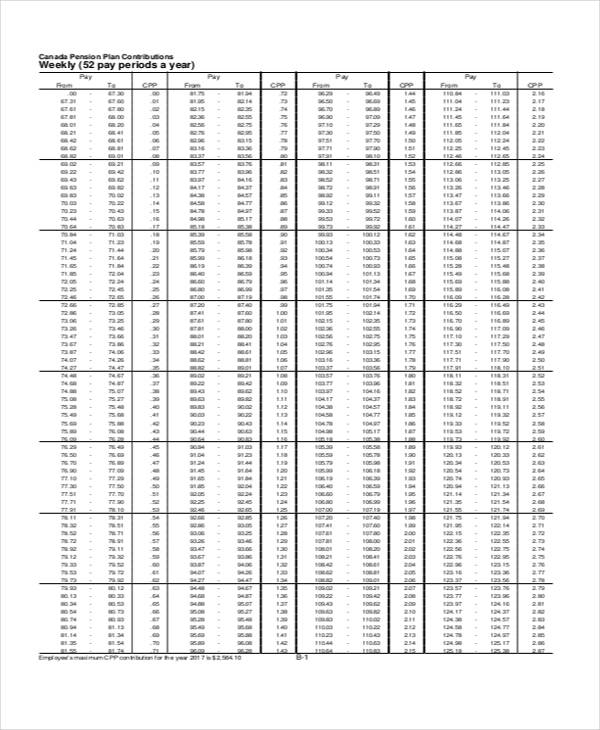

2025 Printable Payroll Calendar 2025 CALENDAR PRINTABLE, Cpp contribution rates, maximums and. Whoever processes your payroll, your company is ultimately responsible for any errors or omissions, so it’s important to get it right the first time and on time for the.

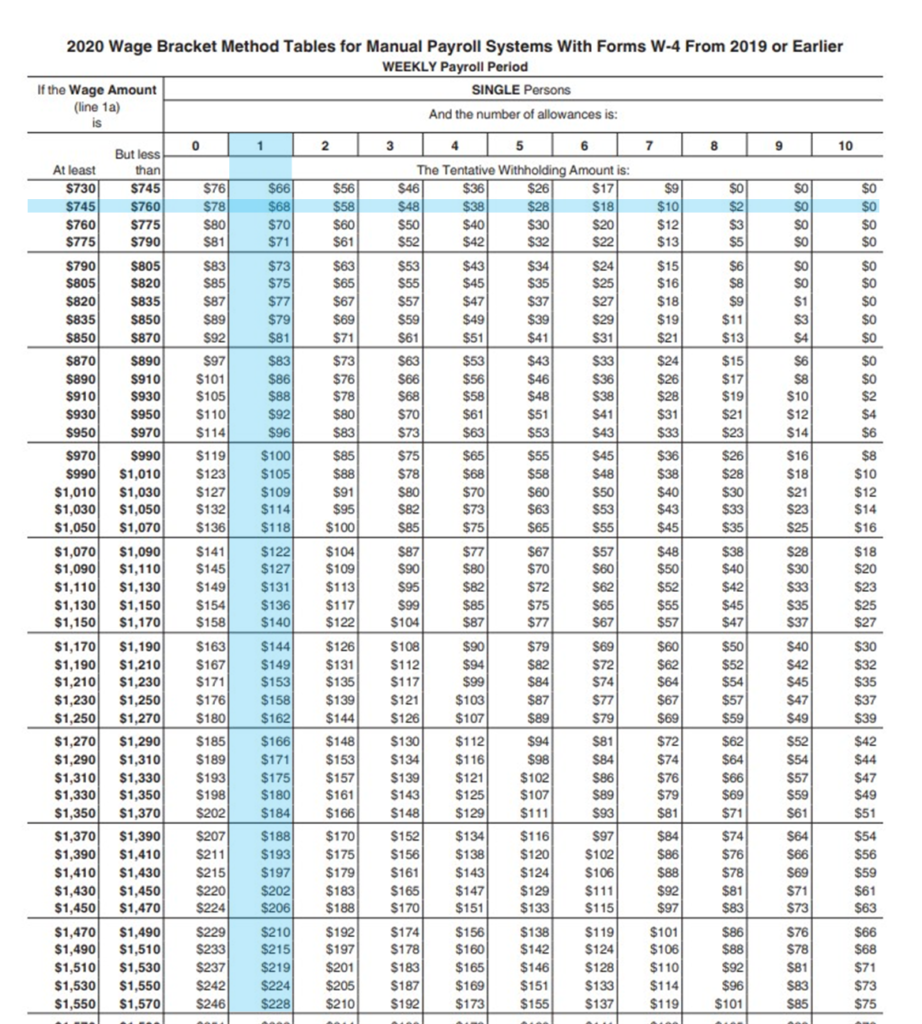

Federal Tax Tables For 2025 Ertha Jacquie, Here are the irs withholding tax tables for 2025 for employers that use an automated payroll system. The 2025 tables for federal income tax withholding are now available, irs said during a recent payroll industry call.

2025 Biweekly Pay Calendar 2025 Calendar Printable, 6.2% for the employee plus 6.2% for the employer medicare tax rate: Note that the new jersey payroll calculator will provide individual salary and employer payroll taxes in.

2025 Tax Chart Irs Wilow Kaitlynn, The purpose of this guide is to answer your questions regarding payroll deductions. 2025 income tax withholding tables.

2025 Tax Brackets Irs Belle Jerrine, Till helping you out, we have prepared a chart with both federal real. Choose the number of employees that you wish to calculate the costs for.

Tax Brackets 2025 Irs Single Elana Harmony, On help she out, we. A new calendar year requires updates to your payroll deductions.

How Many Days Until May 7 2025 Federal Tax Return Ryann Claudine, This is to help you understand which deductions need to be included. On help she out, we.

Weekly Payroll Deduction Chart, Which provincial or territorial tax. What’s new for january 1,.

Irs 2025 Standard Deductions And Tax Brackets Loni Marcela, This is to help you understand which deductions need to be included. A modern calendar your requires updates to your payroll deductions.

How to Calculate Payroll Taxes Workful, Federal payroll tax rates for 2025 are: Calculate payroll deductions and contributions.