Nj Income Tax Brackets 2025. The average tax refund is bigger so far this year. The nj tax brackets vary between 1.4% and 10.75%, depending on your filing status and adjusted gross income.

The nj tax brackets vary between 1.4% and 10.75%, depending on your filing status and adjusted gross income. Karin price mueller | nj.

In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

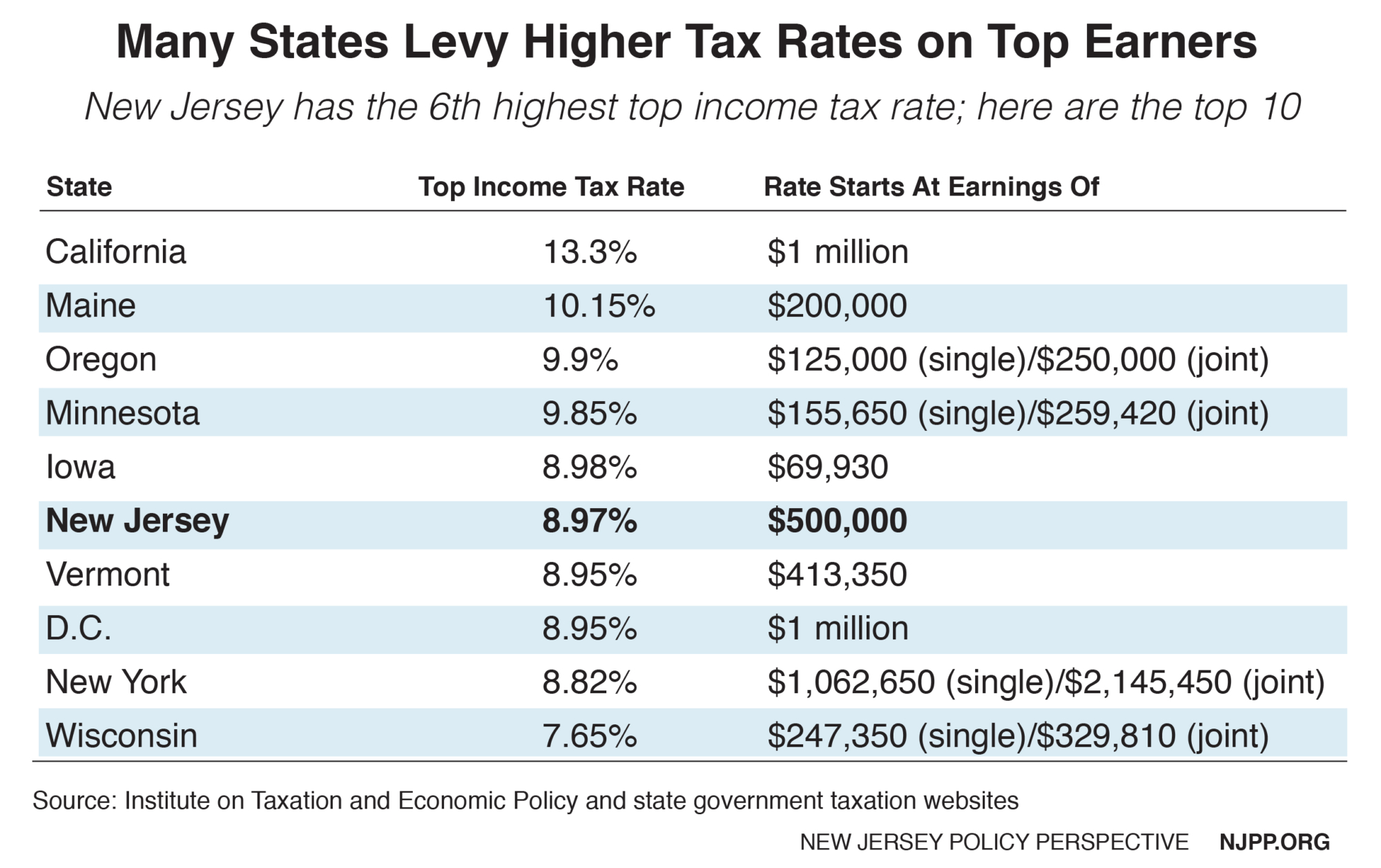

Road to Recovery Reforming New Jersey's Tax Code New Jersey, New jersey residents state income tax tables for single filers in 2025 personal income tax rates and thresholds; There are seven tax brackets for single filers in new jersey (eight for joint filers), ranging from 1.4 percent to 10.75 percent.

Road to Recovery Reforming New Jersey's Tax Code New Jersey, Tax rate taxable income threshold; Since a composite return is a combination.

Tax rates for the 2025 year of assessment Just One Lap, Since a composite return is a combination. Per the irs, almost 44.6 million taxpayers have submitted their tax returns so far in 2025.

Reforming New Jersey’s Tax Would Help Build Shared Prosperity, Danielle currie treasury encourages eligible taxpayers to take advantage of nj’s earned income tax credit, one of the. Income tax tables and other tax.

Reforming New Jersey’s Tax Would Help Build Shared Prosperity, January 15, 2025 4 check if paid preparer filed. The federal income tax has.

New Jersey State Taxes Taxed Right, Detailed new jersey state income tax rates. This tool is designed for simplicity and ease of use, focusing.

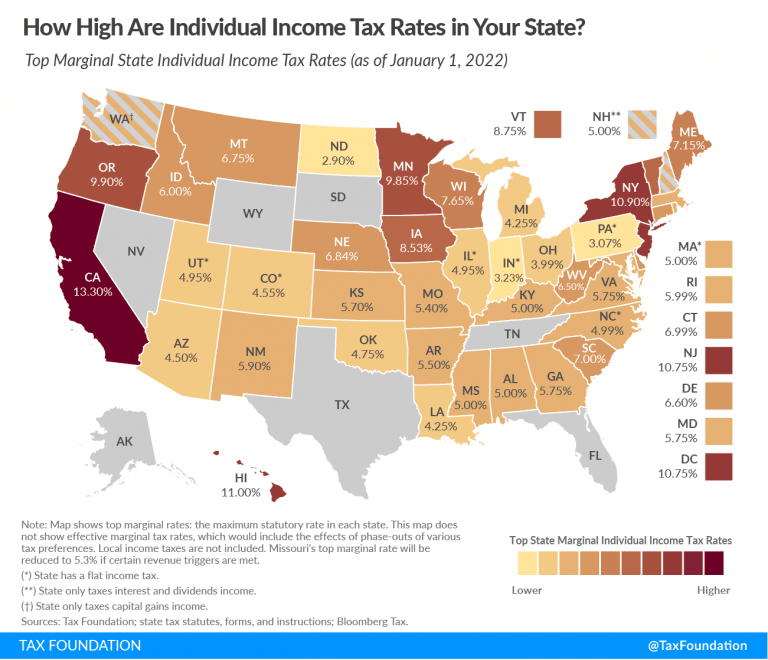

2025 state tax rate map Arnold Mote Wealth Management, Property and sales taxes are also above average. Danielle currie treasury encourages eligible taxpayers to take advantage of nj’s earned income tax credit, one of the.

Irs 2025 Standard Deductions And Tax Brackets Danit Elenore, Income tax tables and other tax. The nj tax brackets vary between 1.4% and 10.75%, depending on your filing status and adjusted gross income.

Reforming New Jersey’s Tax Would Help Build Shared Prosperity, Income from $ 20,000.01 : The average tax refund is bigger so far this year.

State Corporate Tax Rates and Brackets for 2025 Tax Foundation, January 15, 2025 4 check if paid preparer filed. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ).

The 2025 tax year standard deductions will increase to $29,200 for married couples filing jointly, up $1,500 from $27,700 for the 2025 tax year.

There are seven tax brackets for single filers in new jersey (eight for joint filers), ranging from 1.4 percent to 10.75 percent.