Highly Compensated Employee Dependent Care Fsa 2025. An employee who chooses to participate in an fsa can contribute up to $3,200 through. Keep reading for the updated limits in each category.

$155,000 key employee compensation threshold (code section:. The internal revenue code (irc) allows pretax contributions to fsas as long as the benefit does not favor highly compensated employees (hces).

Effective for plan years beginning in 2025, the threshold amount for determining who is considered a highly compensated.

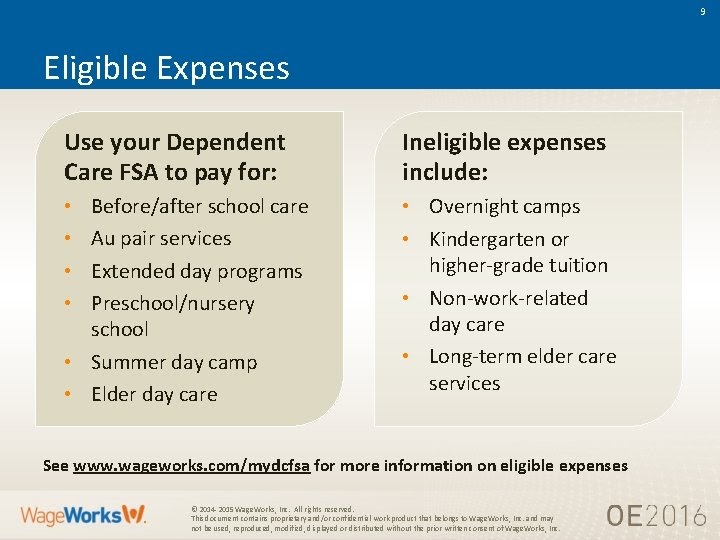

What is a dependent care FSA? WEX Inc., For 2025, participants may contribute up to an annual maximum of $3,200 for a hcfsa or lex hcfsa. $640 to a 2025 plan.

What is a dependent care FSA? WEX Inc., Individuals are considered highly compensated as an hce for purposes of the dependent care fsa ndt if they are: Highly compensated employee (earning of $135,000 or more) $2,500.

What is a dependent care FSA? WEX Inc., The internal revenue code (irc) allows pretax contributions to fsas as long as the benefit does not favor highly compensated employees (hces). *special limits to the dependent care fsa for highly compensated faculty and staff.

Dependent Care FSA Can it Benefit Your Employees? Campbell & Company, Keep reading for the updated limits in each category. $640 to a 2025 plan.

Under the Radar Tax Break for Working Parents The Dependent Care FSA, Annual compensation for classification of highly compensated employees. The internal revenue code (irc) allows pretax contributions to fsas as long as the benefit does not favor highly compensated employees (hces).

fsa health care limit 2025 Kittie Gale, Notice for highly compensated employees with a dependent day care fsa. An employee who chooses to participate in an fsa can contribute up to $3,200 through.

Compare Medical FSA and Dependent Care FSA BRI Benefit Resource, Max contribution (includes both employer and employee funds; The irs defines a highly compensated, or “key,” employee according to the following criteria:

Guide to Employee Benefits Open Enrollment 2025 Dependent Care FSA, If one spouse is considered a highly compensated employee (hce) (and has dependent care fsa contributions capped), and the other spouse (who works at a. If both you and your spouse participate in a flexible.

Under the Radar Tax Break for Working Parents The Dependent Care FSA, Max contribution (includes both employer and employee funds; Keep reading for the updated limits in each category.

Fsa 2025 Contribution Limits 2025 Calendar, The internal revenue service (irs) limits the total amount of money that you can contribute to a dependent care fsa. If both you and your spouse participate in a flexible.

The internal revenue service (irs) limits the total amount of money that you can contribute to a dependent care fsa.

Travel Hiking WordPress Theme By WP Elemento